Do you think LMS can assist insurance companies too?

For over a decade, I’ve been a part of the corporate training landscape, dedicating a significant portion of that time to crafting training specifically for insurance agents and their clientele.

This journey led me to delve deep into a bunch of online training tools, giving me a firsthand perspective on what truly works — and what doesn’t.

In this article, I’ve curated a list of best LMS tools that stand out for their exceptional support to the insurance industry, based on both their features and my personal experiences.

Here’s a sneak peek of the tools:

| Tool | Best for | Price |

|---|---|---|

| Mintbook LMS | Personalized training | One-time purchase license at $4000. |

| ProProfs Traning Maker | Comprehensive employee training including built-in assessment and certification. | Forever free for up to 10 learners. Paid plan starts at $1.99/learner/month for large teams. |

| Skill Lake LMS | AI-driven training | Starts at $49 per month. |

| Academy of Mine | White-label training | Starts at $299 per month. |

| Samelane | Collaborative learning | Starts at €2.5 per month. |

| MindScroll | Interactive learning | Starts at $29 per month for up to 50 active users. |

| SmarterU | Compliance training | Starts at $299 per month. |

| Violet LMS | Mobile training | Custom pricing. |

List of Best Insurance LMS Software

In coming up with this list, I drew on my professional experiences, consulted my colleagues in the industry, read reviews in software comparison sites, and incorporated client testimonials.

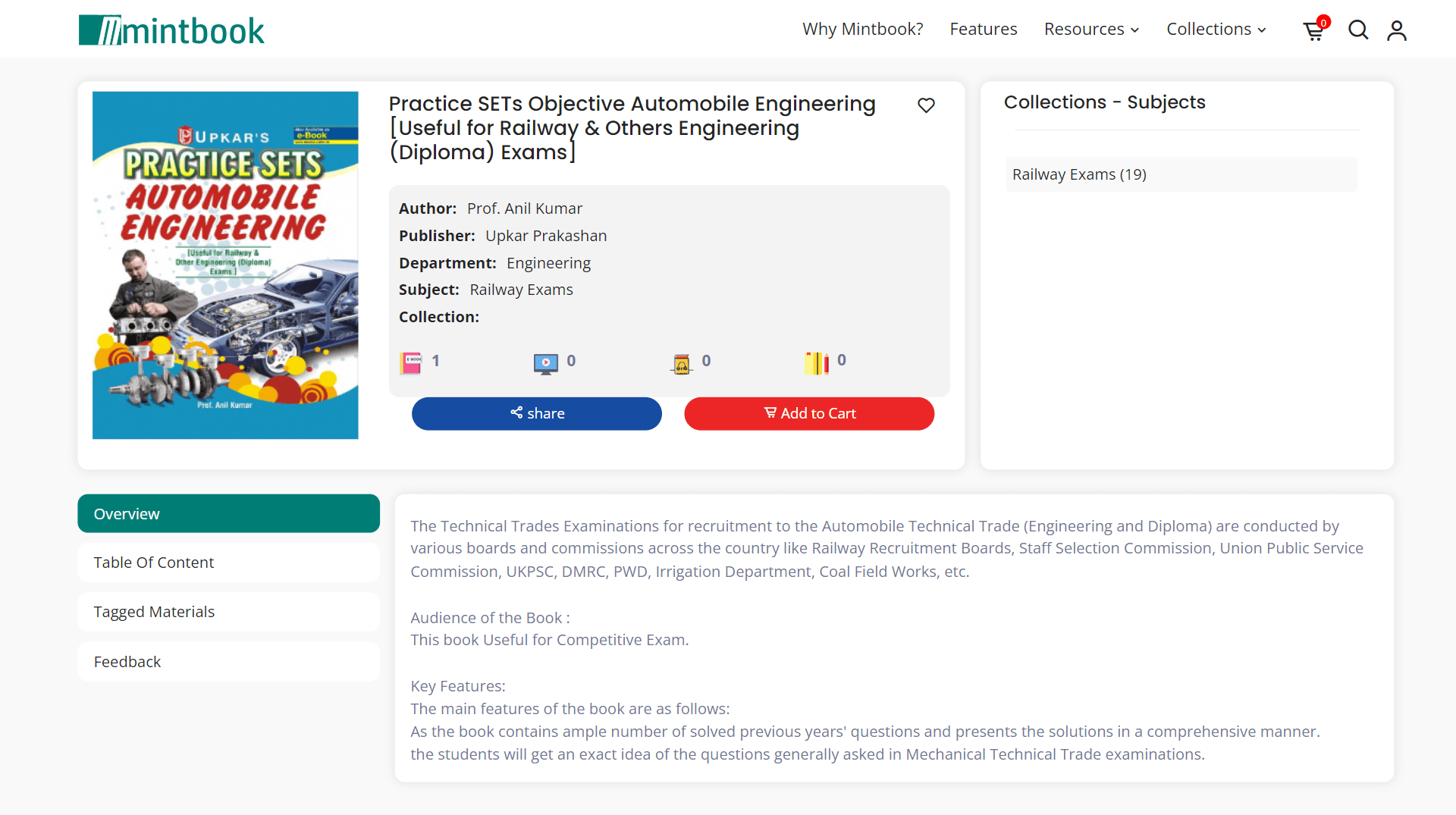

1. Mintbook LMS – Best for Personalized Learning

When we talk about personalized learning, Mintbook LMS is perhaps one of the best choices.

And this is because you can develop training modules that address the specific challenges and skills needed in the insurance field.

Whether it’s product knowledge, compliance regulations, or customer interaction skills, Mintbook allows you to craft content that resonates with your learners.

I like the multiple online learning models in Mintbook LMS, such as self-based learning, virtual instructor-led learning, and blended learning. These models can cater to different learning preferences and styles of the learners.

Need bite-sized learning or microlearning?

This smart LMS for insurance companies offers microlearning that breaks down complex topics into bite-sized nuggets that can be consumed anytime.

It also includes learning paths that involve creating customized courses based on learners’ previous history and skill gaps.

What You Will Like:

- Enables easy training in different branches and geographic locations on one platform.

- Access to training materials on mobile devices for learners who are on the move.

- Microlearning features for complex topics to prevent skill gaps.

- Digital library with eBooks, videos, journals, and quiz forums from reputed publishers.

- Create your own branded online academy with custom domains, logos, colors, and themes.

What You May Not Like:

- Not compatible with some existing platforms of insurance companies, such as CRM, ERP, and HRMS.

- No robust security system to protect sensitive and confidential data.

Pricing:

One-time purchase license at $4000.

2. ProProfs Training Maker – Best for Easy Online Employee Training & LMS

If you are looking for an all-in-one insurance LMS for employee training, I would suggest ProProfs Training Maker.

Recently, I’ve noticed this tool being used across various industries and sectors that are transitioning to online training. ProProfs Training Maker facilitates comprehensive employee training anytime and anywhere.

What really stands out is that it’s an AI-powered LMS, which means you can build custom courses faster by simply adding a topic or uploading your existing content—like policies, guidelines, or PDFs—and the system converts it into structured, interactive lessons.

You can access a customizable library of 100+ ready-to-use courses for a quick start.

You can train the employees in 70+ languages and enable multiple instructors for collaborative learning and sharing.

It also enables pre-employment assessments for insurance companies with 1,000,000+ questions that are a part of the ProProfs Training Maker library.

ProProfs Training Maker helped us create online health insurance training courses and share them with our executives in an organized and detailed manner.

Jennifer Cole

Broker Services and Account Relations Coordinator, Health First Health Plans

ProProfs Training Maker also offers robust reporting and tracking features to monitor employee progress and compliance with regulatory requirements. And one of the things that makes it unique is the smart task management feature, which includes calendar reminders. Instructors can use the training calendar to plan, schedule, and manage training sessions and for learners to know about upcoming sessions.

Besides, you can integrate the LMS with other systems and tools, such as HRIS, CRMs, and third-party content providers.

What You Will Like:

- Setting reminders for course completion and meeting compliance.

- Collaborative training environment with a Q&A forum.

- Secure quizzes, accessible to only select users using smart settings.

- Responsive mobile apps for learning on the go, and offline learning support to access content without the internet.

- Real-time learner reports based on detailed statistics and analytics.

What You May Not Like:

- The free plan doesn’t provide access to premium courses.

- Frequent updates, which might require occasional adaptation.

Price:

FREE for up to 10 learners. Plans start at $1.99/learner/month for 10+ users. No hidden fees. A 15-day money-back guarantee.

Simplify Insurance Training

Adopt a tailored LMS for the insurance industry.

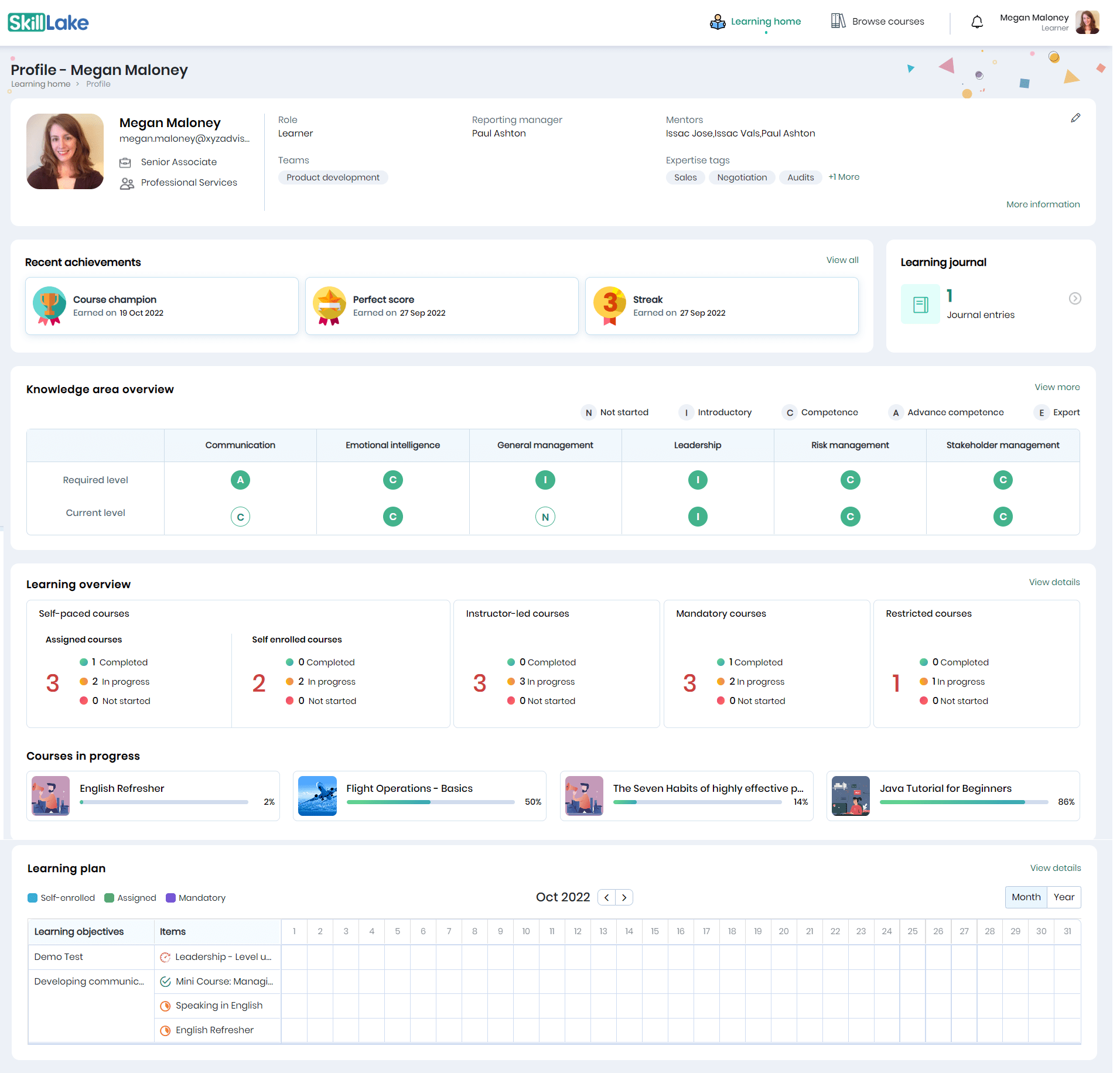

3. Skill Lake LMS – Best for AI-Driven Training

Need a modern insurance LMS that is backed up by AI?

You can bank upon Skill Lake LMS, an AI-enabled learning management system for personalized and engaging learning experience.

When I delved deeper to know this functionality in the LMS, I found that it uses AI to recommend courses that match learners’ skills, department, and interests based on their previous learning history and skill gaps.

No doubt, this helps learners discover relevant and useful courses faster and easier.

You can also access multiple content formats within a course, such as videos, text, images, documents, audio clips, and more.

This helps learners access diverse and rich learning materials that suit their preferences and needs.

Not just this, Skill Lake’s AI can understand your questions in English (or any language you prefer). So, if you’re stuck on a concept, just ask, and it will provide explanations in a way that’s easy to understand.

What You Will Like:

- AI-powered analysis of learners’ progress, preferences, and strengths to suit their individual needs.

- Supports micro-learning so that content can be consumed quickly and conveniently.

- Enables learners to develop their skills by conducting graded and guided tests and assessments.

- Intuitive and secure mobile app for android and iOS for learning on the go.

- Supports SSO, granular role-based controls, and more; complies with the enterprise security standards.

What You May Not Like:

- Does not support niche learning needs as it focuses on corporate training and development.

- Not enough customization options for the course curriculum and content.

Price:

Starts at $49 per month.

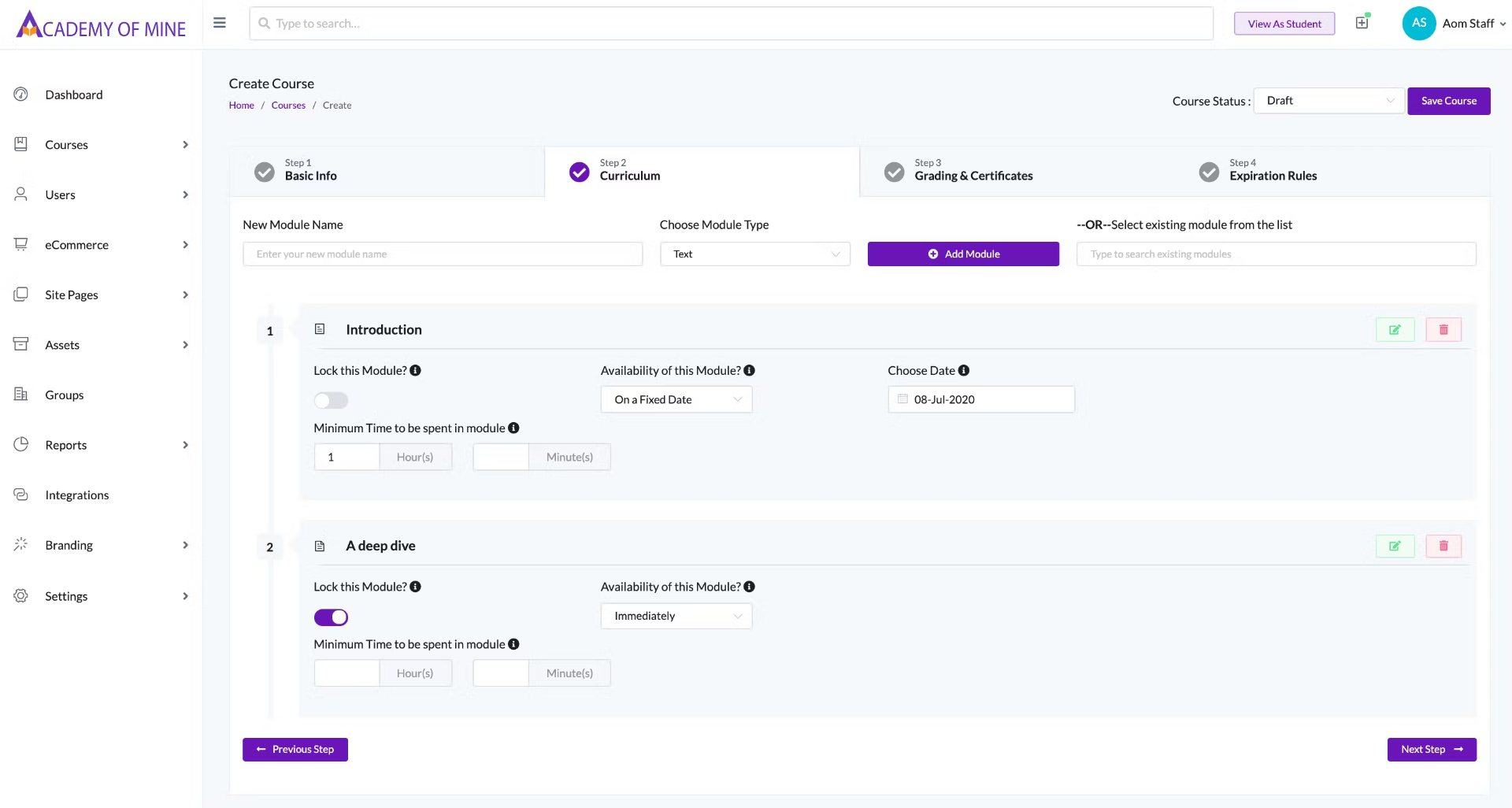

4. Academy of Mine – Best for White-Label Training

When it comes to white-labeling, I found Academy of Mine to be one of the best insurance LMS on the market.

Academy of Mine allows insurance companies to brand the learning platform as their own completely.

This means the platform, courses, and materials can carry the insurance company’s logo, colors, and branding, providing a seamless and professional look to all training materials.

It can also track and manage compliance training, ensuring that all employees are up to date with the latest industry standards and regulations. It also provides automated certification processes.

One of the most unique features of this LMS for insurance benefits is the multi-tenancy support.

This feature allows the creation of separate branded learning portals for different clients or departments – all managed from a single, centralized platform.

It can also integrate with existing systems and tools used by insurance companies, such as CRM software, HR systems, or performance management tools to streamline data management and reporting.

What You Will Like:

- Streamlined instructor-led training with integrations such as Zoom and MS Teams, as well as in-person sessions.

- Insurance certification programs with robust certificate features and integration with credential apps like Accredible.

- Automated notifications and reminders to employees about upcoming training requirements or deadlines.

- 24/7 personalized customer support and additional services such as course development and data migration.

- Provides unlimited courses, users, and customer portals with flexible e-commerce options.

What You May Not Like:

- Does not have enough video guides to illustrate how to work with the platform.

- Tailoring the platform to your exact needs can be time-consuming and may require technical expertise.

Price:

Starts at $299 per month.

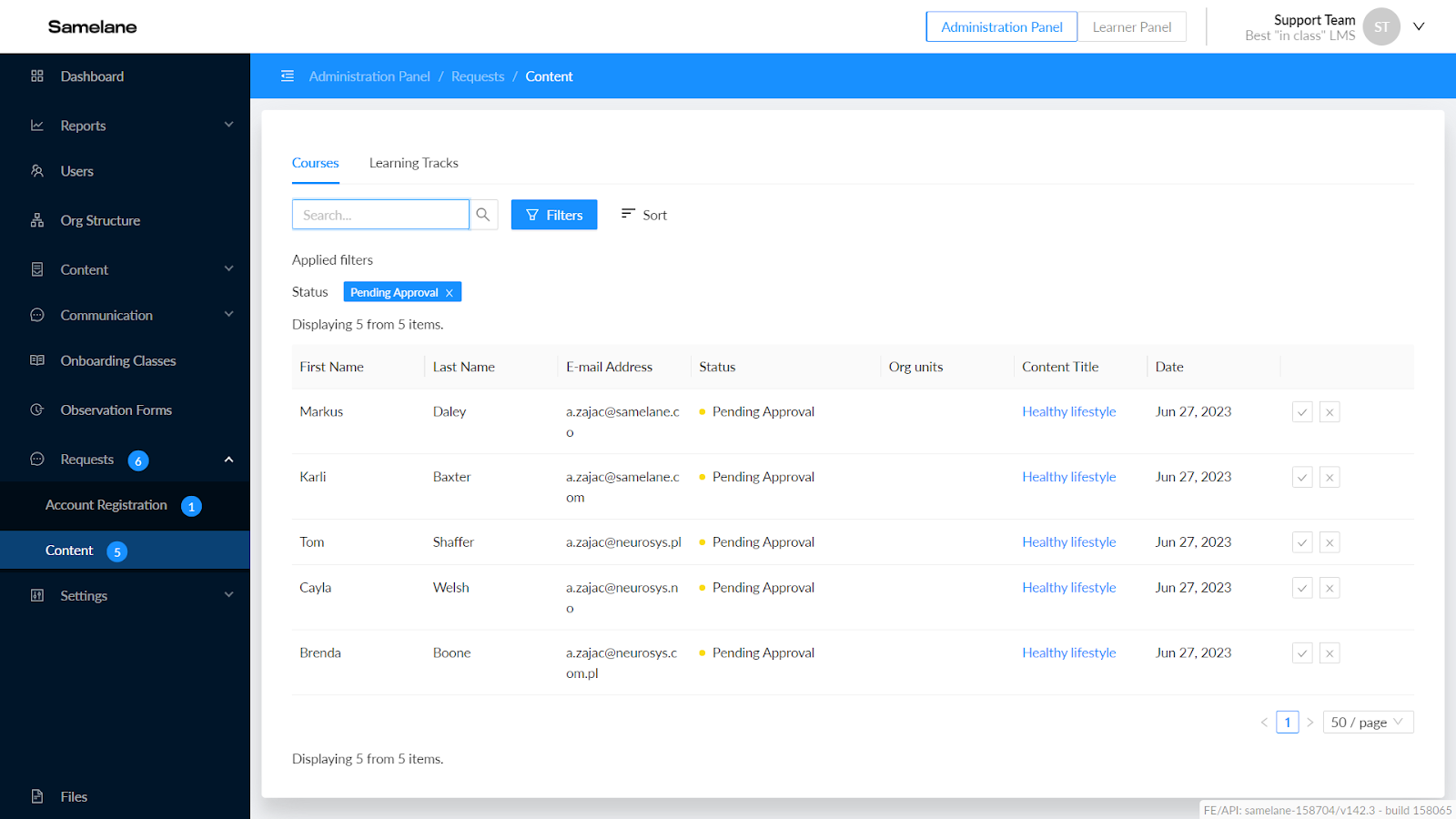

5. Samelane – Best for Collaborative Learning

Wish to try an LMS for insurance agencies with an ultra-modern approach?

Samelane is the only LMS platform on the market with MR (mixed reality), AR, and VR integrations.

I really like the augmented reality feature that allows you to perform training in any habitual environment enhanced by the virtual models of machines to create a unique, immersive learning experience.

But, one of the best aspects of this LMS is its collaborative learning feature.

Samelane LMS fosters collaborative learning by allowing you to provide training, certification, support, and instant communication to your partners, vendors, and franchisees.

You can boost your partner enablement strategy and turn your associates into a successful business unit.

Besides, group user management is also a cool feature.

You can generate comprehensive reports on various aspects of your training program, such as completion rates, engagement levels, knowledge gaps, and more.

What You Will Like:

- Create and assign compliance courses, track completion, and generate audit-ready reports.

- Foster a collaborative learning culture by enabling social features, such as forums, chats, blogs, and wikis.

- Personalized and relevant learning recommendations based on learners’ profiles, behavior, and feedback.

- Mobile-friendly courses that adapt to different screen sizes and orientations.

- Integration with your existing systems and tools, such as CRM, ERP, HRIS, LMS, email, calendar, and more.

What You May Not Like:

- Faces technical glitches that can disrupt the learning process.

- Customer support is not strong enough to provide timely and effective assistance.

Price:

Starts at €2.5 per month.

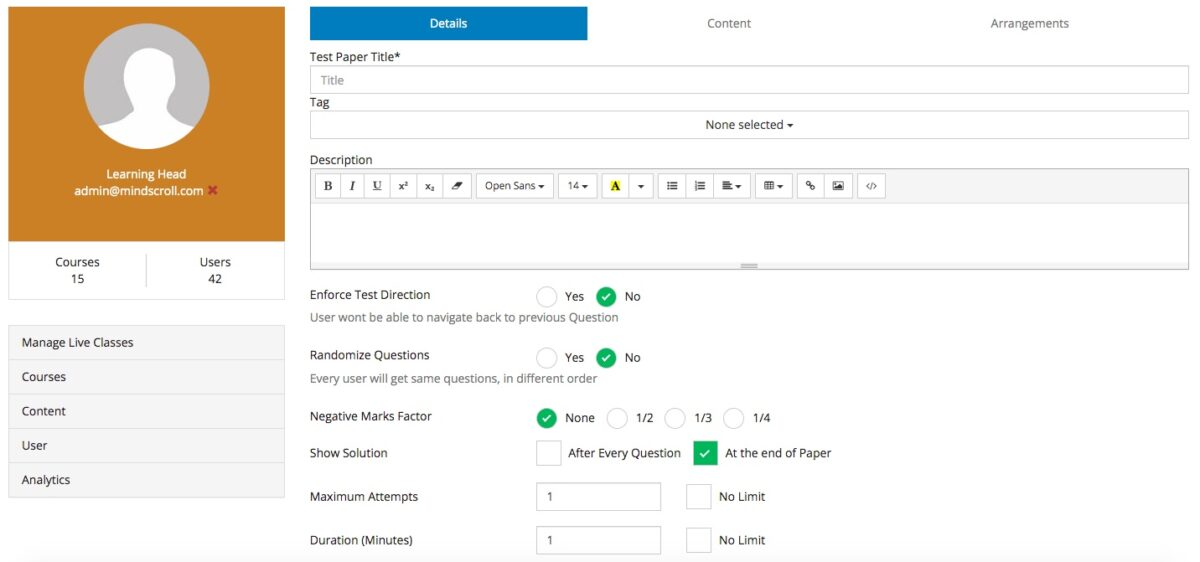

6. MindScroll – Best for Interactive Learning

Learning shouldn’t be a boring affair when you’re leveraging an LMS for tax and insurance training.

Mindscroll LMS can make it as interactive as you wish.

It supports the creation of interactive training content, including videos, simulations, quizzes, and scenarios that can engage insurance professionals.

Besides, I love the gamification feature of the MindScroll LMS, which includes elements such as leaderboards, badges, and points that can make training more engaging, motivating, and competitive.

One of the unique features of this LMS is the ability to create branching scenarios that allow learners to make choices within a simulated environment.

For an insurance company, this can lead to different outcomes based on their decisions, which can be particularly useful for claims and customer service training.

What You Will Like:

- Live virtual classroom integration with video conferencing, screen sharing, and chat.

- Robust assessment tools with various question types, including multiple-choice and scenario-based questions.

- You can assign specific training paths based on job roles and responsibilities.

- Customizable dashboards for learners and administrators.

- Centralized content repository for insurance-specific training materials and regulatory documents.

What You May Not Like:

- Does not support offline learning.

- Does not have a native mobile app.

Price:

Starts at $29 per month for up to 50 active users.

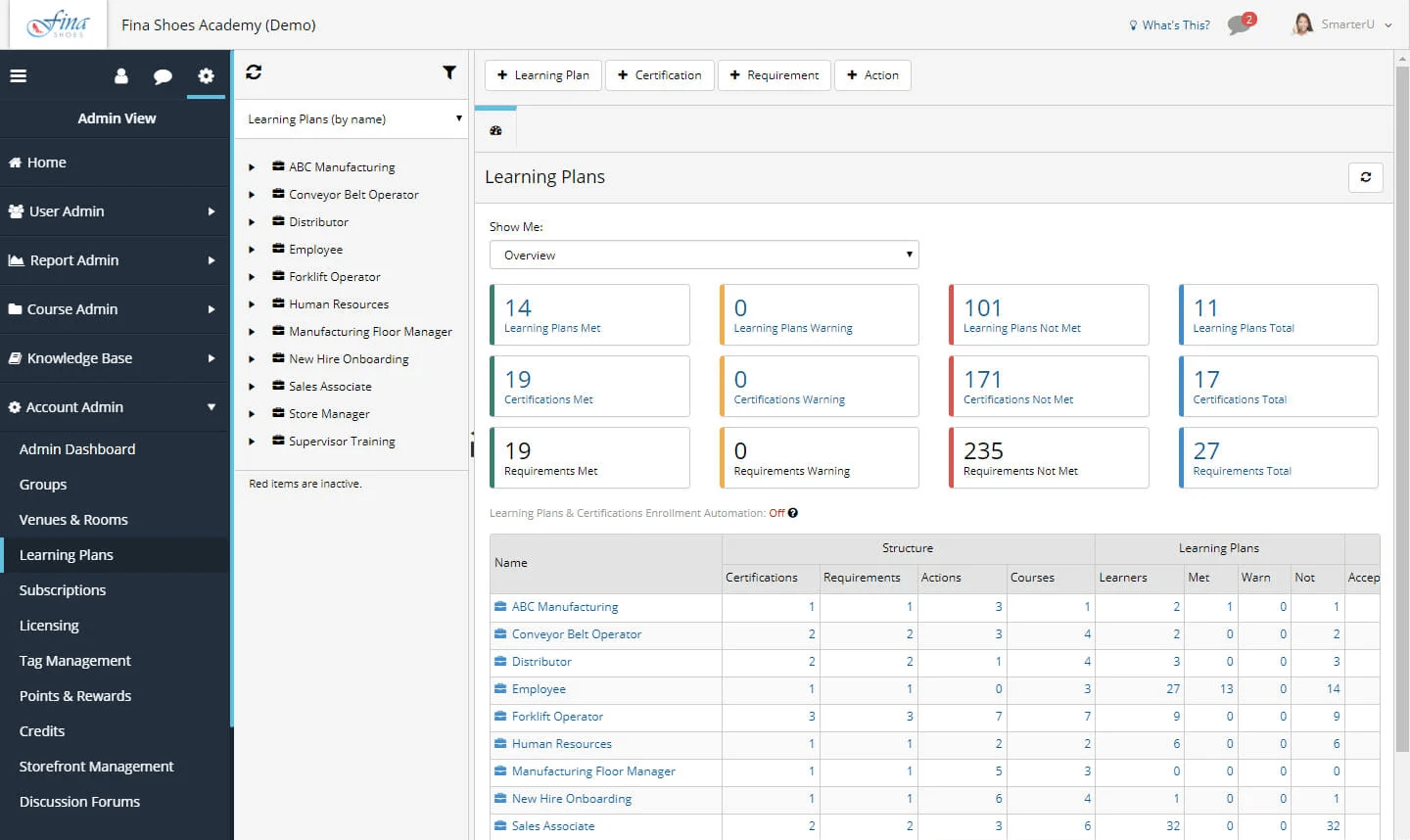

7. SmarterU – Best for Compliance Training

As far as insurance companies are concerned, compliance training of employees can play a huge role in the success of the organization.

And I really like the feature-packed interface of SmarterU that fosters compliance training in an easy, bite-sized module.

It allows insurance companies to create and customize compliance courses tailored to their specific industry regulations and policies. Plus, you have robust tracking and reporting tools to monitor and record compliance training progress and completion.

The detailed audit trails and logs in the LMS demonstrate compliance efforts. They can be essential in case of regulatory audits or legal requirements.

It comes with automated email reminders and notifications to ensure employees are aware of upcoming compliance training requirements and deadlines.

Even its continuous learning paths, where employees receive ongoing updates and training as regulations evolve, are a wonderful aspect for insurance companies.

What You Will Like:

- Distinct compliance training modules based on job roles and responsibilities.

- Fully branded login portal, course slides, and completion certificates.

- Supports instructor-led training, both online and offline, for self-paced e-learning courses.

- Interactive assessments, quizzes, and tests to evaluate employees’ understanding of compliance regulations.

- Version control features to manage updates and changes to compliance documents.

What You May Not Like:

- It does not offer a free version or a free trial.

- It does not have many integrations with other software or platforms, such as Moodle, Salesforce, Zapier, etc.

Pricing:

Starts at $299 per month.

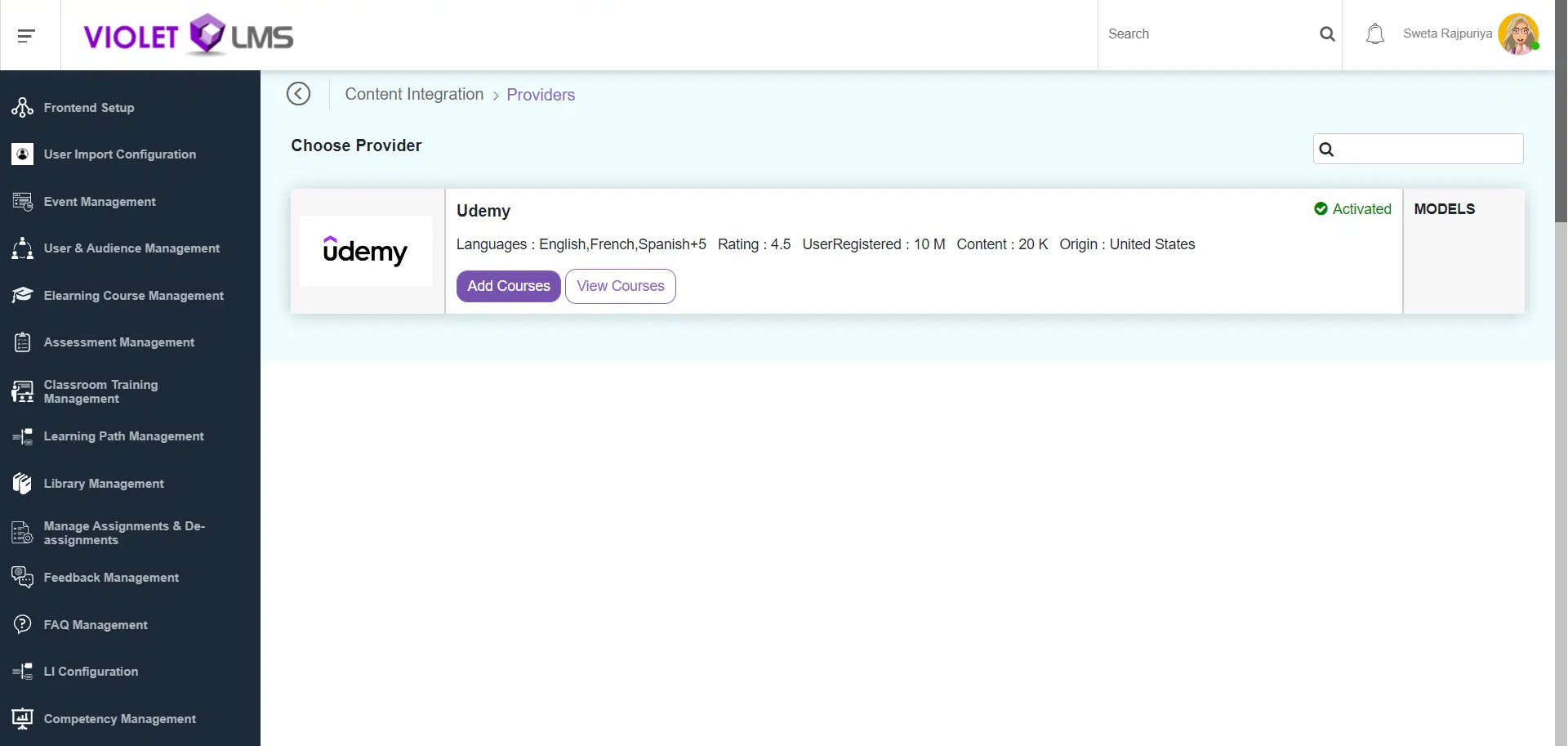

8. Violet LMS – Best for Mobile Training

If you are looking for an insurance LMS that can be accessed anytime, anywhere – even on the go, you can count on Violet LMS.

This is one of the best LMS for mobile training since it contains a responsive design that adapts to various screen sizes, ensuring a seamless user experience on smartphones and tablets.

One of the remarkable features of this learning management system is that you can download training materials for offline access.

This is particularly valuable for insurance professionals who may need to access content in remote or low-connectivity areas. It even contains a dedicated mobile app that provides a seamless and branded learning experience for insurance company employees.

Violet LMS also supports multiple languages and time zones. This can help cater to the diverse and global customer base of the insurance industry, as well as the different regulations and standards across regions.

What You Will Like:

- Push notifications on mobile devices to remind the learners about training sessions or new content.

- Mobile-friendly assessments and quizzes that learners can complete on their smartphones or tablets.

- Personalized learning paths that can be tailored to the roles and needs of each user.

- Enroll in courses, webinars, or training events from any mobile device.

- Gamification elements such as points, badges, leaderboards, and certificates to motivate and engage learners.

What You May Not Like:

- Software is not updated frequently and lacks the latest features and functionalities.

- Involves high cost; not suitable for small and medium-sized businesses.

Price:

Custom pricing.

Ready to Pick the Best Insurance LMS?

After a detailed description of the most popular learning management systems for insurance companies, let’s sieve out the best from the rest.

I have picked three insurance LMS that I found highly suitable, and these are as follows:

Mintbook LMS

Mintbook LMS excels in personalized learning for the insurance industry. It allows the creation of tailored training modules addressing specific insurance challenges and skills, such as product knowledge, compliance, and customer interaction.

The platform offers diverse online learning models, including self-paced, virtual instructor-led, and blended learning, accommodating various learning preferences.

For quick, effective learning, Mintbook offers microlearning with bite-sized content. It also facilitates the creation of customized courses through learning paths based on individual learner histories and skill gaps.

ProProfs Training Maker

ProProfs Training Maker can be your go-to insurance LMS for comprehensive employee training. It’s widely adopted across various industries, making it accessible for training employees anytime, anywhere.

With a library of over 100 expert-designed courses, customization is at your fingertips. ProProfs Training Maker supports training in 70+ languages and allows multiple instructors for collaborative learning.

You can even conduct pre-employment tests with a vast question bank. Robust reporting and tracking features ensure you can monitor employee progress and meet regulatory requirements.

Plus, it offers seamless integration with other systems like HR software, CRM, and third-party content providers to cater to your unique needs.

SmarterU

SmarterU is a highly useful platform when it comes to crucial compliance training for insurance companies. Its feature-rich interface offers easily digestible, bite-sized modules for effective learning.

You can tailor compliance courses to industry-specific regulations, and its robust tracking and reporting tools keep a close eye on training progress and completion.

It also has detailed audit trails and logs that demonstrate compliance efforts, vital for audits and legal obligations. Automated email reminders ensure employees stay on top of upcoming training requirements.

After a careful review of the features of these LMS, I think ProProfs Training Maker is the best insurance LMS that can help in the overall training and development of the employees. It’s user-centric, fully configurable, and scalable. Also, with smart assessments and actionable reports, you can keep track of learners’ progress and goal achievements.

Learn More About Insurance LMS:

What is an Insurance LMS?

An insurance LMS is a specialized software platform used by insurance companies to streamline employee training and development. It’s tailored to the unique needs of the insurance industry, offering tools for creating, delivering, and tracking training content. This includes topics like product knowledge, compliance regulations, and customer service skills. Insurance LMS platforms help ensure employees stay up-to-date with industry standards, regulations, and company policies while offering flexibility in how they learn, enhancing overall performance and compliance.

Watch: What is a Cloud-Based Learning Management System?

;

What are the key features to look for in an Insurance LMS?

The key features to consider in an insurance LMS include customized content creation, compliance tracking, robust lms reporting, learning path flexibility, multi-language support, and integration capabilities with other systems. These elements ensure tailored training, regulatory compliance, effective monitoring, diverse learning options, global accessibility, and seamless workflow integration.

How to choose the right LMS for the Insurance industry

Start by identifying specific training needs and compliance requirements. Look for platforms offering customization, compliance tracking, reporting, and flexible learning paths. Assess integration options, user-friendliness, and scalability to align with long-term goals. Seek user feedback and consider industry reputation for a well-informed decision.

Watch: How to Choose the Best LMS Software for Employee Training

Who can benefit from the Insurance LMS?

An insurance LMS can benefit insurance companies of all sizes in training their employees effectively. It is valuable for insurance agents, underwriters, claim adjusters, customer service representatives, and other staff involved in the insurance industry. It ensures they are well-equipped with industry-specific knowledge and skills.

Tips

Tips

We’d love to hear your tips & suggestions on this article!

Get Free LMS Software — All Features, Forever.

We've helped 567 companies train 200,000+ employees. Create courses in under a minute with our AI LMS or use 200+ ready-made courses on compliance, harassment, DEI, onboarding, and more!

We'd love your feedback!

We'd love your feedback! Thanks for your feedback!

Thanks for your feedback!

![12 Best Enterprise Learning Management Systems in 2025 [Free & Paid Platforms]](https://www.proprofstraining.com/blog/wp-content/uploads/2024/08/Feature_TM_Enterprise-Learning-Management-Systems_-Features-Benefits-and-Best-Tools.png)