I’ve seen firsthand how crucial it is for teams in the banking and finance sector to keep their skills sharp and adhere to compliance rules, policies, and procedures. The stakes are incredibly high in this industry—one misstep can lead to compliance issues, financial losses, and even reputational damage. 90% of financial institutions see a clear link between solid employee training and happier customers, not to mention better compliance, safety, and a boost in revenue.

With the industry changing quickly and regulations popping up left and right, having a top-notch learning management system (LMS) for banking is necessary. If you’re yet to adopt one such solution, explore these 10 LMS software options designed specifically for banking and financial services in 2025.

| LMS for Banks | Best For | Pricing |

|---|---|---|

| ProProfs Training Maker | Easy Online Employee Training & LMS | Forever FREE plan for small teams. Paid plan starts at $1.99/learner/month. |

| Docebo | Complex Enterprise Training | Custom pricing |

| LearnUpon | Delivering Impactful Training | Starts at $599/month (billed annually) |

| eFront | Supporting Training at Scale | Starts at $1,200/month |

| GyrusAim | Competency Rating | Starts at $5,500/year (up to 100 users) |

| Moodle | Open Source Learning | Free plan available; Paid plans start at $134/year |

| Paradiso | White Labeling | Free plan available; Paid plans start from $5.50/user/month |

| 360Learning | Collaborative Learning | Starts at $8/user/month |

| SkyPrep | Online Training & Employee Development | Custom pricing |

| Skillcast | Delivering Compliance Success | Starts at $378.38/year |

What Is an LMS in Banking?

An LMS, or Learning Management System, in banking, is a special online platform that helps banks train their employees. It makes learning easy and organized. With an LMS, banks can offer courses on essential topics like customer service, compliance, skills, data security, and new technology.

Employees can access training materials anytime and anywhere, which helps them learn at their own pace. The LMS also tracks progress so managers can see how well their team is doing.

Why Do You Need LMS in the Banking and Finance Sector?

75% of financial institutions report improved customer satisfaction when they invest in employee training. Plus, banks prioritizing training see an average 20% increase in revenue. That’s huge! So, why exactly do banks and financial services need a LMS? I’ll explain:

First, it’s all about enhanced employee onboarding and training. An LMS centralizes all your training materials and makes it easy for new hires to get up to speed quickly. Plus, it ensures everyone gets the same high-quality training.

Next, consider compliance and regulatory adherence. The banking sector is highly regulated, and an LMS helps keep everyone up-to-date with the latest rules and regulations. It also simplifies tracking and reporting, a lifesaver during audit time.

Cost-effectiveness and efficiency are also big wins. Traditional training methods can be pricey and time-consuming will all the logistics and physical infrastructure. An LMS cuts down on those costs, for example, by enabling you to go completely paperless.

Customer service and sales performance get a boost, too. Well-trained employees mean happier customers and better sales. It’s a win-win!

And let’s not forget about building a future-ready workforce. An LMS helps prepare employees for future challenges and industry changes. It encourages continuous learning and development, keeping your team adaptable and skilled.

So, there you have it! Implementing an LMS in the banking and finance sector is not only a good idea but essential for staying competitive and ensuring long-term success.

What Are the Key Features of an LMS for the Banking Industry?

When choosing a financial learning management system, there are certain features you need to consider:

- AI Course Creation: One of the prominent features found in many LMS today is course creation with AI. This feature enables you to create onine courses in minutes. All you have to do is feed your course topic and ideas to the system, and then it generates courses instantly.

- Automated Certification Tracking: With constantly evolving regulations, it’s critical to stay on top of certifications. A superior LMS will automatically track when employees need recertification and send reminders to help you avoid costly compliance lapses.

- Customizable Learning Paths: Different roles in banking require different types of training. An LMS allows you to create tailored learning paths so that each employee, whether a loan officer, risk manager, or compliance team member, gets the right training based on their specific job function.

- Multiple Instructors: The financial LMS should allow multiple instructors to contribute to courses and manage learners. This provides flexibility and distributes the workload.

- Quizzes and Assessments: To reinforce learning and measure understanding, the LMS should have robust quizzing features with various question types and the ability to provide feedback.

- Upload Existing Materials: Banks often have existing training materials. The LMS should allow easy uploading of various formats, such as videos, PDFs, presentations, and SCORM packages.

- Reporting and Analytics: You need clear insights into training progress. An LMS offers detailed reports that show who has completed courses, who is falling behind, and how effectively the training is meeting compliance requirements.

- Mobile Accessibility: Banking operates around the clock, and so should learning. A mobile-friendly LMS enables employees to access training on the go, whether during a break or on their commute.

- Robust Security: Given the sensitive data involved in banking, top-notch security features like encryption, secure logins, and role-based access—are necessary. This ensures that all information within the LMS remains safe.

10 Best Learning Management Systems for Banks

Did you know that Bank of America was fined $225 million for failing to comply with various banking regulations? This serves as a stark reminder of the consequences that can arise from inadequate training and compliance processes. An effective LMS can help banks avoid such pitfalls by providing structured and consistent company-wide training.

Here are some of the best LMSs that can help you achieve this goal.

1. ProProfs Training Maker – Best for Easy Online Employee Training & LMS

Reflecting on my first-hand experience with ProProfs Training Maker, I’ve found that it’s a wonderful finance learning management system. It empowers teams with online training, covering everything from new hire onboarding to compliance standards.

You can train employees on financial frauds, scams, anti-money laundering, terrorist financing, and the rules of governing bodies such as the FTC, SEC, and CFPB.

While building a course on fraud detection protocols, I used the platform’s AI course generator, added the topic, and the course was ready. That’s when I realized how much time you can save with an AI-powered learning management system like ProProfs—it takes over the repetitive parts like formatting, structuring, and even quiz creation, so you can focus more on the content itself.

Moreover, it offers ready-to-use courses taught by industry experts and the flexibility to customize content. Its e-learning authoring tool lets you create courses from scratch using your existing documents, podcasts, videos, PDFs, etc.

What You Will Like:

- Virtual classroom lets you manage your users and courses with ease

- Enables mobile learning by allowing you to access your courses from any device and location

- Integrated quiz maker helps you create engaging assessments for your learners

- Create and embed surveys into your courses to collect feedback, measure satisfaction, and improve your courses

- The certification functionality adds a layer of credibility and accountability to training

- The user-friendly interface, single sign-on security, and real-time tracking make it an invaluable asset for any financial institution

What You May Not Like:

- No downloadable or on-premise version

- Dark user interface option is not yet available

- No dedicated account manager for the free plan, unlike the paid version

Pricing:

Forever FREE plan for small teams. Paid plan starts at $1.99/learner/month with a 15-day money-back guarantee. There are no hidden charges.

Need a Secure LMS for Banking & Finance Training?

Simplify compliance training and upskill your workforce with ease.

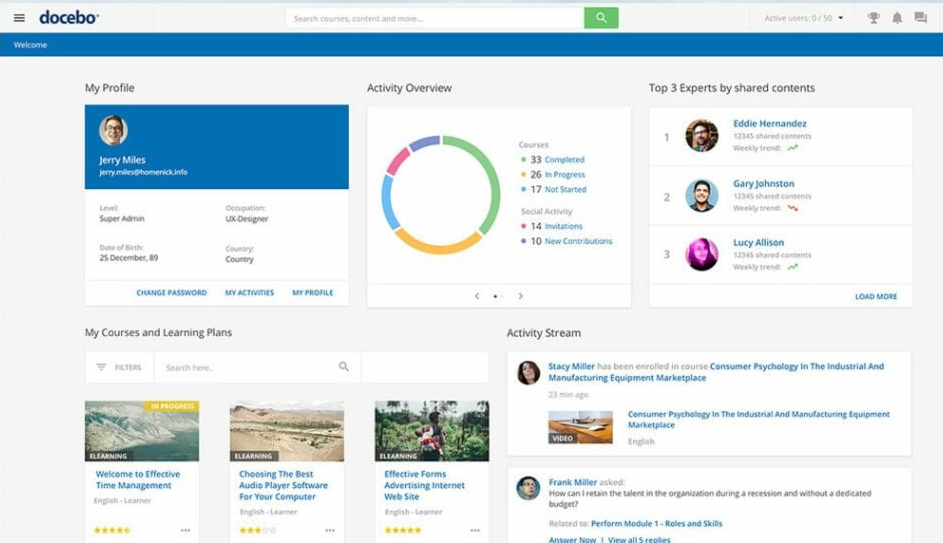

2. Docebo – Best for Complex Enterprise Training

For me, Docebo LMS is like discovering a powerful ally in finance and banking. It’s not just another software tool but a solution that understands the challenges faced by financial organizations.

One of the best parts is how it keeps all e-learning content in one place, with version control to ensure consistency and compliance. Plus, the focus on reducing risk stands out. Having accurate training records and audit trails is a lifesaver, especially when dealing with regulations.

I also appreciate how it automates managing users and courses across different branches, making things easier and saving time. Its AI tools help people and businesses stay up-to-date with new skills. Docebo’s AI-powered recommendations even create personalized learning paths for each user based on their needs and goals.

What You May Like:

- The adaptive learning technology adjusts the difficulty of the content to each user’s level of understanding

- The gamification features make learning fun and engaging. This helps users stay motivated and on track

- The social learning features allow users to connect with other learners and share knowledge

- Enhanced survey techniques to engage and incentivize learners

What You May Not Like:

- The learning curve can be steep, especially for users who are not familiar with LMS

- The mobile app is not as user-friendly as the desktop version

- Some features, like the gamification module, are only available in higher pricing tiers

Pricing:

Custom pricing

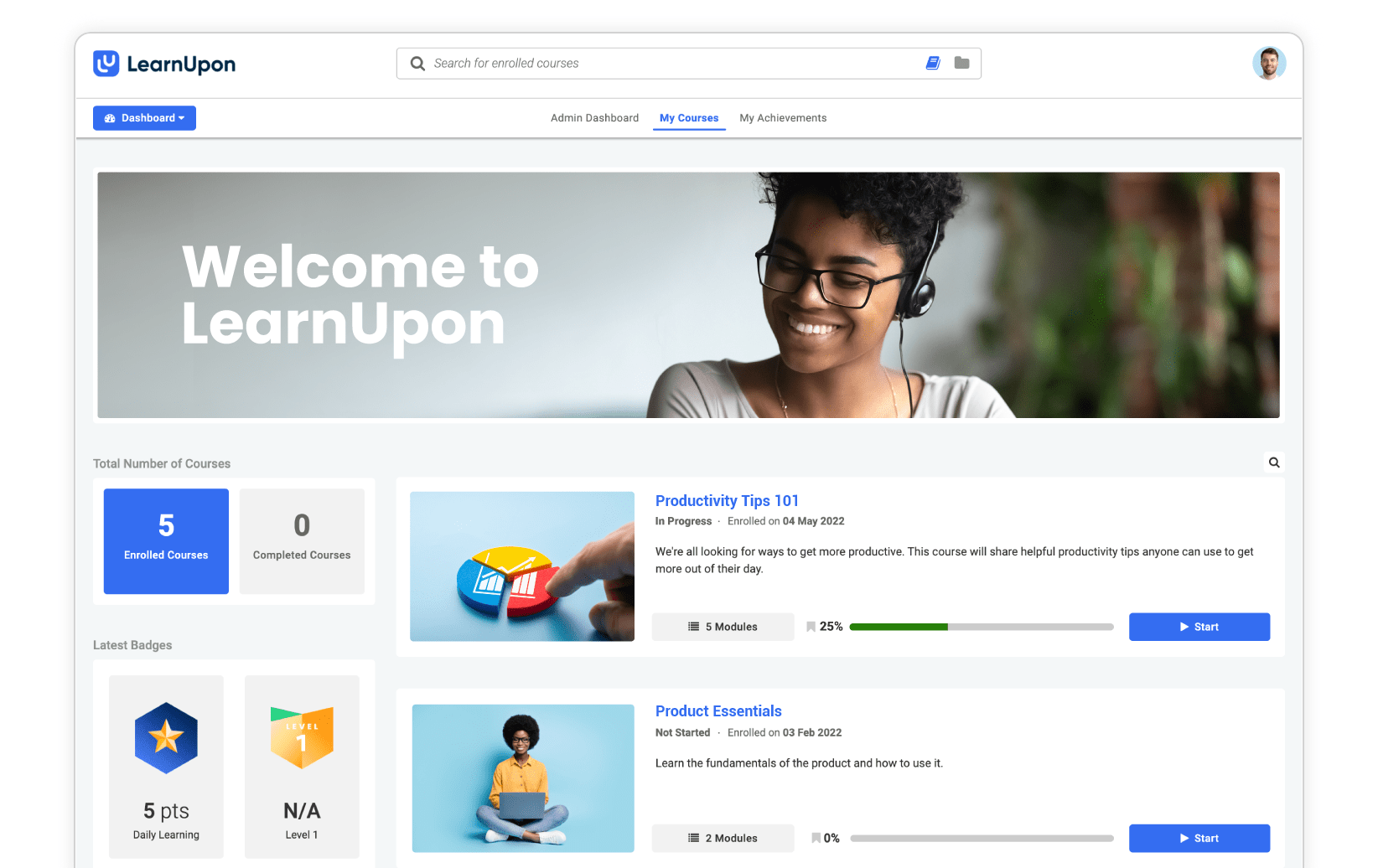

3. LearnUpon – Best for Delivering Impactful Training

For me, LearnUpon makes running webinars for finance professionals super easy and effective. It’s a cloud-based LMS that covers everything—from course creation and user management to learner engagement, reporting, and webinars—all in one simple platform.

What I love is how easily it integrates with webinar tools like Zoom, GoToWebinar, and Adobe Connect. The setup is totally hassle-free—there’s no need for a developer! Plus, you can record and replay sessions, so if someone misses the live event, they can always catch up later.

LearnUpon also boosts the learning experience with features like blended learning, automatic attendance tracking, and support for different time zones. It even helps manage multiple sessions, sends notifications, and keeps global audiences engaged without breaking a sweat.

What You Will Like:

- Allows you to conduct live polling and Q&A during your webinar sessions

- Detailed reporting and analytics on training attendance, engagement, and performance

- Interactive bots to make learning more impactful with AI

- AI-generated summaries of courses and modules that help learners review key concepts and content

What You May Not Like:

- Some of LearnUpon’s features, such as gamification and social learning, are only available in the higher plans

- LearnUpon’s branding and user interface are not as customizable as some other LMS

- Searching for courses as an admin is challenging, especially when you have different versions of the same course

Pricing

Paid plans start at $599/month (billed annually)

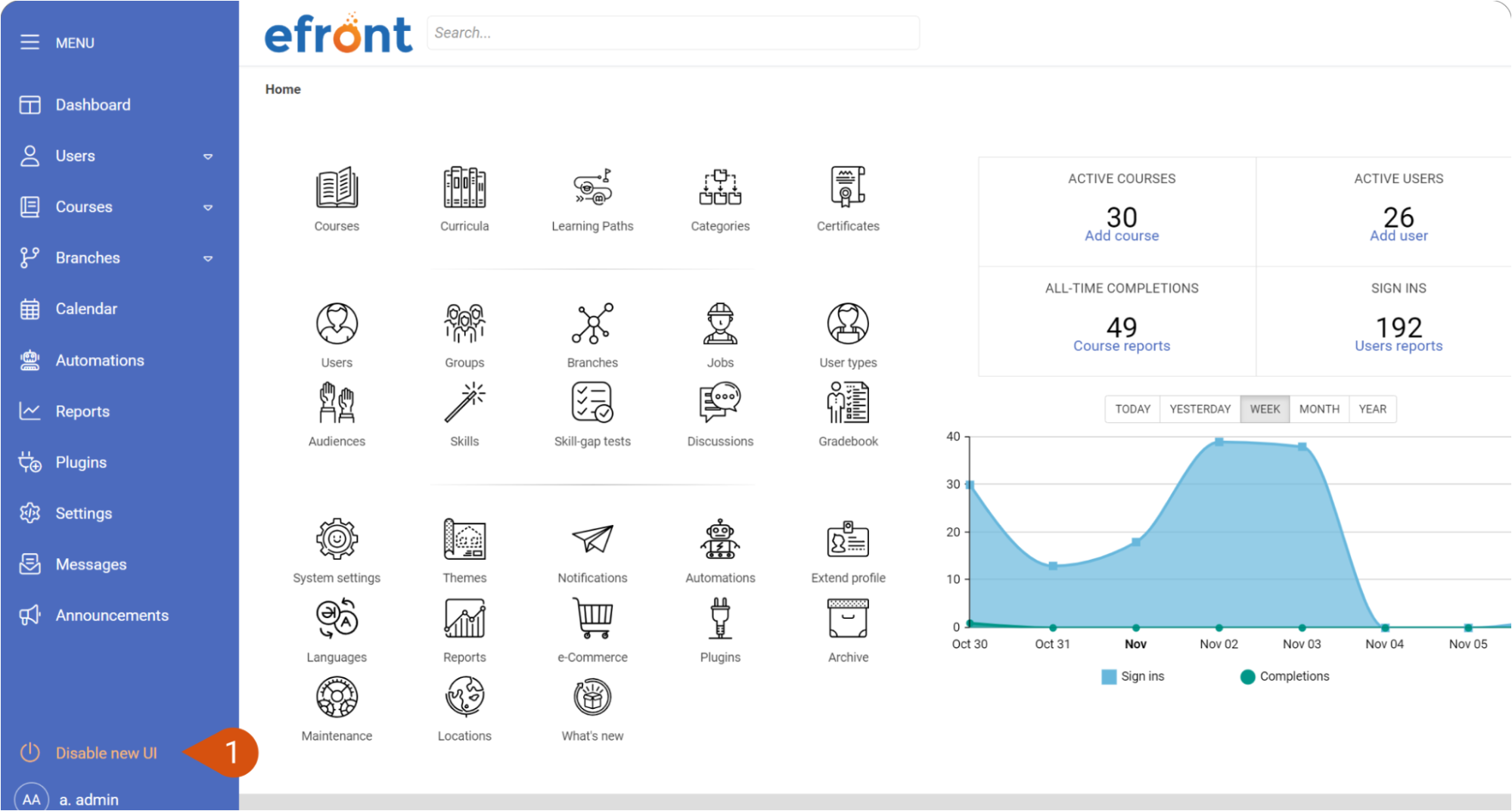

4. eFront – Best LMS for Supporting Training at Scale

eFront is an advanced LMS tailored to the industry’s needs. It helps financial organizations overcome challenges by providing scalable training solutions. It streamlines onboarding, enhances compliance, promotes technology adoption, and reduces costs.

The next tool I would love to add to my lineup is eFront. It’s an enterprise-grade LMS that’s all about providing flexible, scalable training solutions. What really stands out to me is how it’s built specifically for large organizations, offering features that go beyond the basics of course management.

From creating interactive learning experiences with multimedia content to issuing custom certifications for compliance, eFront covers it. It even supports blended learning, combining online and in-person training, which is helpful for complex financial training programs.

Moreover, the platform lets you customize everything—from branding to user access—without needing deep tech skills. Its multi-tenancy feature is great for large companies with multiple branches, so it ensures each unit has the specific training it requires.

What You Will Like:

- Create custom reports to track user actions and system activities

- Assign courses based on trainees’ skills, closely monitoring their progress and ensuring targeted growth

- Identify employee weaknesses through skill-gap tests and address their specific needs

- Build individualized training programs around job roles to boost employee focus and overall productivity

What You May Not Like:

- Has a slightly outdated graphical interface that may not appeal to some users

- Does not support LTI/PENS standards for content interoperability

- Does not allow the bulk download of completion certificates

Pricing:

Paid plans start at $1,200/month. Skill gap testing. Multi-tenancy.

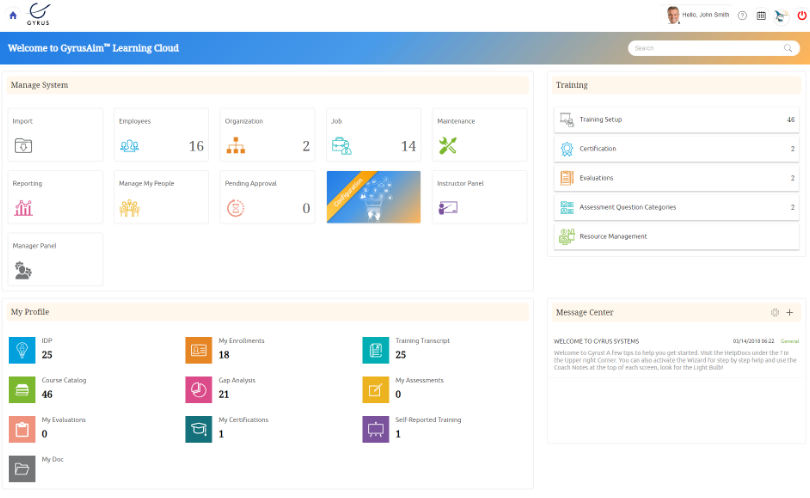

5. GyrusAim – Best for Competency Rating

Experience the power of GyrusAim, a great LMS designed for banking and finance. With users in over 25 countries, this award-winning platform offers a smooth, customizable learning environment that caters to diverse needs.

GyrusAim excels at streamlining financial services through personalized learning paths, which makes training relevant for all. It easily integrates with your existing systems and shines on mobile devices, so learners can access content whenever and wherever they need it.

One of the coolest features is the integrated Competency Ratings. This lets you create skill rating systems and track performance seamlessly, bridging the gap between online learning and on-the-job training. Plus, Gyrus simplifies the validation of employee skills and keeps you aligned with compliance needs. You can customize rating formats, monitor progress, and enhance compliance all in one place. Gyrus makes training effective and straightforward!

What You Will Like:

- Provides in-depth insights into learner performance to optimize training strategies

- Integrates with existing systems, such as HRIS and CRM platforms, ensuring a smooth user experience

- Responsive design ensures that learners can access training content anytime, anywhere

- Allows you to create personalized learning journeys for each user, catering to their specific needs and skills

What You May Not Like:

- The platform entails a steep learning curve for both administrators and learners

- While highly customizable, tailoring GyrusAim to precise requirements may involve extensive configuration

- Managing and maintaining GyrusAim could require significant time and resources, especially for organizations with limited staff or IT support

Pricing:

Paid plans start at $5,500/year. Up to 100 users.

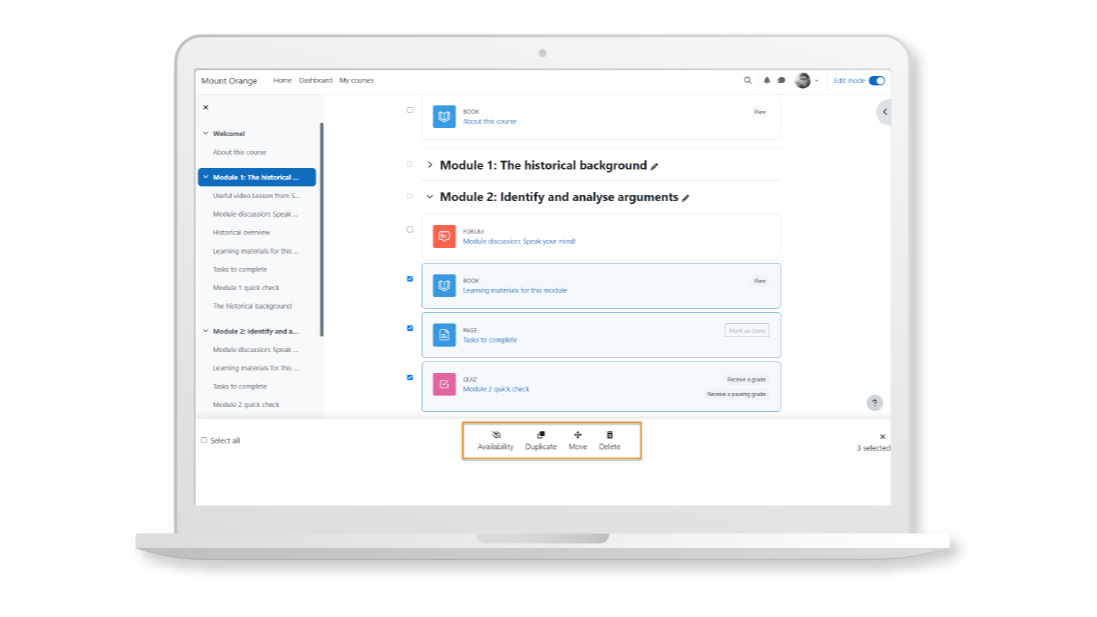

6. Moodle – Best for Open Source Learning

Moodle is one of the best learning management systems for banks. With its open-source model, anyone can access, modify, and share the source code. Trainers can customize the system to fit their unique needs without the usual limitations of proprietary software.

Moodle offers flexibility and scalability for creating and managing online courses, tracking student progress, and generating detailed reports on learning outcomes. It comes packed with features like forums, resource sharing, assignments, and grading tools, making it a solid choice for various educational settings.

Moodle has a vibrant community of users and developers. This community contributes to a treasure trove of plugins and resources, keeping the platform robust and fresh. It’s a versatile, cost-effective option that helps educators deliver top-notch learning experiences.

What you will like:

- Offers a wide variety of plugins to extend functionality

- Adheres to accessibility standards, making it usable for learners with disabilities

- Robust scheduling and event management features

- Comprehensive options for quizzes, assignments, and grading

What you may not like:

- Aesthetics might not match newer, more polished LMS platforms

- The vast number of customization options can be overwhelming for new users

- Non-technical staff might find it challenging to manage without admin support

Pricing:

Free as it’s an open-source platform. The paid plan starts at $134/year. For up to 50 users.

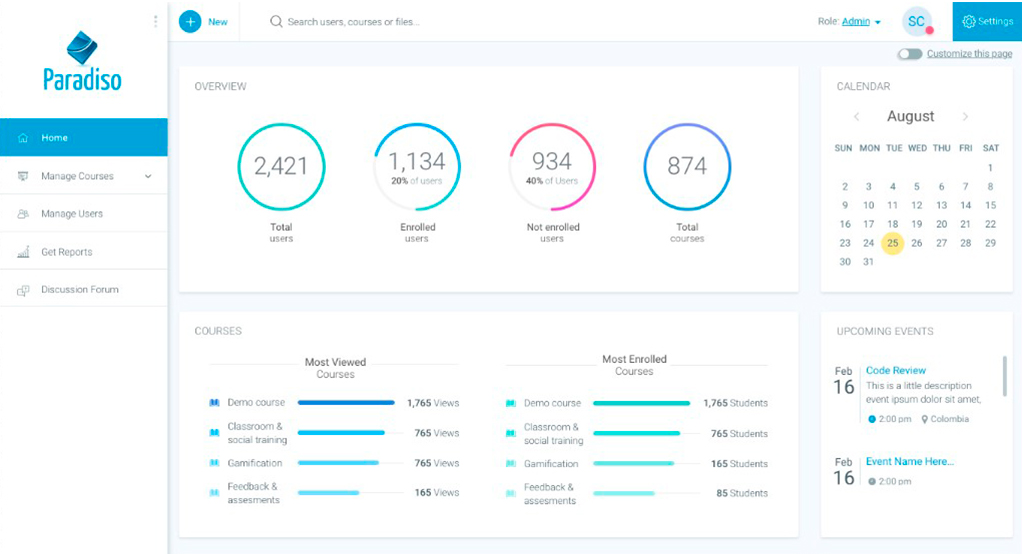

7. Paradiso – Best LMS for White Labeling

Paradiso LMS is an innovative cloud-based eLearning solution designed for the financial sector. As the best white-label LMS, you can personalize the platform’s logo, colors, layout, and more.

With a user-friendly experience, you can customize domain names, implement single sign-on (SSO), integrate various platforms, and create badges and certifications.

Paradiso LMS enables efficient course creation through AI tools for new hires, sales reps, managers, or compliance officers and provides access to a vast library of 80k+ pre-made financial courses.

The system seamlessly integrates with existing tools via APIs, allowing customization to align with brand identity.

Trusted by major institutions, including Bank of America and HSBC, Paradiso LMS conforms to industry standards like SCORM, Tin Can API and GDPR.

What You Will Like:

- Offers an intuitive and user-friendly interface that facilitates easy navigation

- It supports multi-tenancy, which enables users to create and manage multiple subdomains or portals within one LMS

- Optimized for mobile devices, enabling learners to access and engage with their courses anytime, anywhere

- It integrates with many popular platforms, such as Salesforce, Google Apps, Moodle, and more

What You May Not Like:

- Due to its extensive feature set, beginners might experience a steep learning curve

- Requires server resources, making it less suitable for organizations with limited IT infrastructure

- The performance might suffer when dealing with a large number of learners

Pricing:

Free plan available (Limited to 50 users). Paid plans start at $5.50/user/month

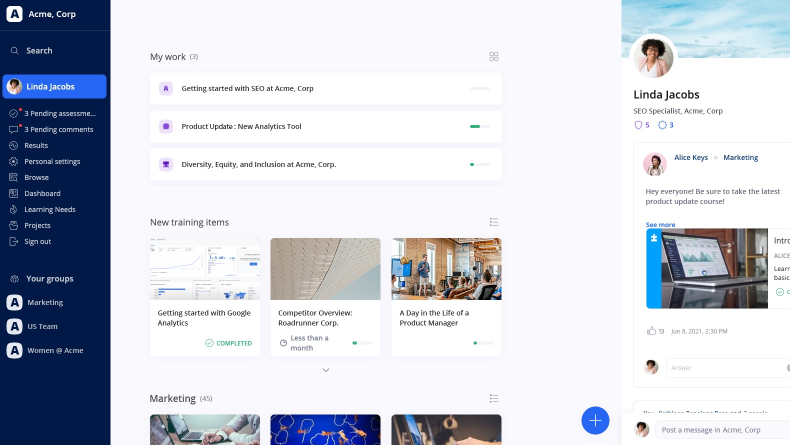

8. 360Learning – Best for Collaborative Learning

Gone are the days of boring, repetitive training that leads to yawns and disengagement. 360Learning flips the script by automating compliance tasks and offering customized training options that make learning feel rewarding.

This platform cultivates a culture of collaborative learning, allowing participants to upskill from within. Engage in interactive courses, harness in-house expertise, and take control of your own learning experience.

With dynamic groups, custom filters, and automated enrollment, 360Learning streamlines the tracking of compliance progress while comprehensive reporting features keep you audit-ready. Ready to revolutionize your compliance training? 360Learning is here to lead the way!

What You Will Like:

- Allows for the creation of engaging content with videos, images, and interactive elements

- Comprehensive reporting and analytics capabilities that help you track the progress and measure the ROI of your learning programs

- Sharing and collaboration, such as social learning communities and the ability to comment on content

- Encourages a continuous feedback loop between learners and instructors

What You May Not Like:

- Instructors who are new to the platform might require a bit of time to get accustomed to its features and tools

- Transitioning existing content from other platforms to 360Learning might pose challenges due to differences in formatting and compatibility

- While 360Learning supports mobile access, full offline access to course materials might be limited

Pricing:

Paid plans start at $8/user/month

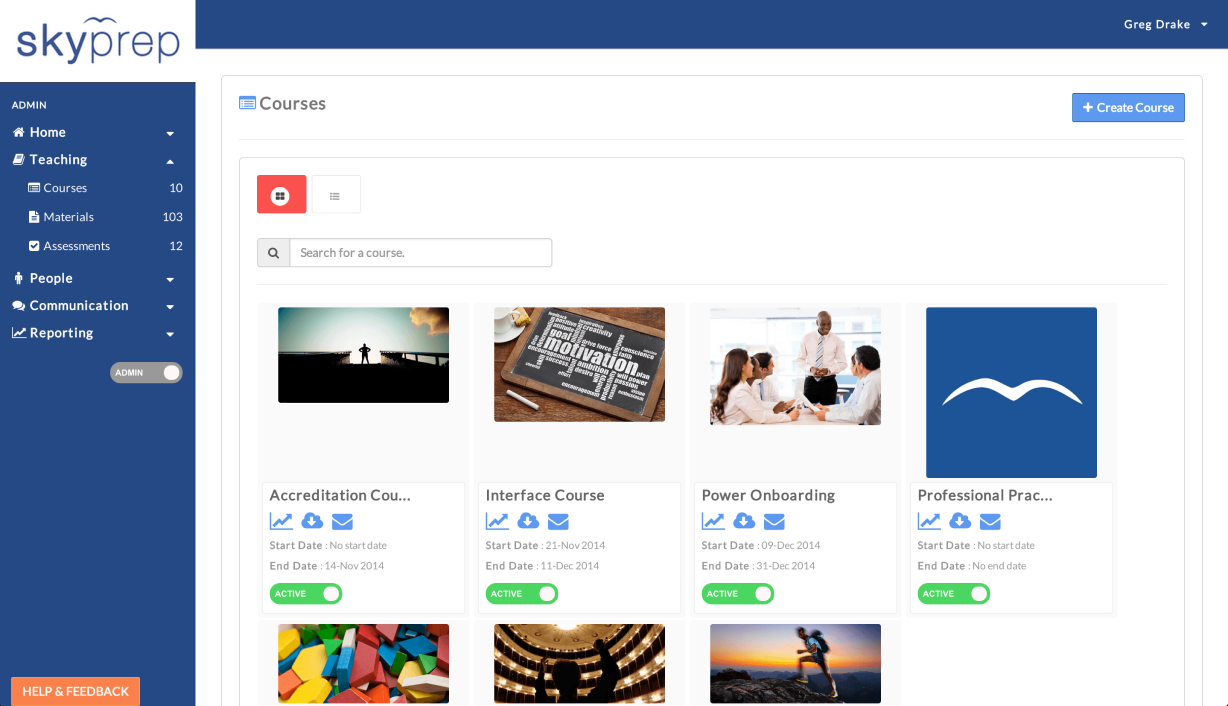

9. SkyPrep – Best for Online Training & Employee Development

If you’ve been struggling to train employees effectively, you’re not alone. Keeping your workforce skilled and engaged in today’s fast-paced marketplace can feel like an uphill battle. That’s where SkyPrep steps in! It simplifies employee training and helps your team shine.

With SkyPrep, you avoid the dreaded culture of disengagement that comes from outdated training methods. Instead, you create a proactive learning environment where employees adapt quickly to new technologies and processes. The result? A team that feels confident and produces top-notch work!

SkyPrep also offers a centralized hub for all training materials so employees can access what they need whenever needed. Plus, you can track training effectiveness with advanced reporting features that reveal how your team is progressing.

What you will like:

- The platform can efficiently manage a large number of users, making it suitable for growing businesses

- Ideal for streamlining employee onboarding and ensuring compliance training is thorough and efficient

- Provides robust reporting and analytics to track progress and performance

- Can be tailored to fit the specific needs of various organizations

What you may not like:

- If you store content outside the resource center, you lose the ability to search child folders.

- The platform does not support creating and tracking training or safety audit checklists tailored to individual roles.

- The feature for sending automatic reminder emails to users is underdeveloped, especially for group notifications.

Pricing:

Custom pricing

10. Skillcast – Best for Delivering Compliance Success

This is another LMS I appreciate, especially for the banking and finance sectors. Skillcast stands out because it goes beyond just delivering standard compliance training—it integrates it seamlessly into everyday work. The platform covers everything from anti-bribery and GDPR to financial crime prevention, which is crucial for highly regulated industries like banking.

What makes it even better is how tailored their approach is. They’ve got sector-specific modules, including FCA Compliance, so you’re not just ticking boxes—you’re genuinely preparing your team for the challenges they’ll face. Plus, their real-time insights and reporting features help track how effective the training is, so you’re always in the know.

Skillcast puts a lot of thought into making compliance training comprehensive and easy to manage. For businesses dealing with heavy regulations, especially in finance, this LMS helps simplify things while ensuring you’re always one step ahead.

What you will like:

- The platform is user-friendly, making it easy to navigate and use.

- A wide variety of courses is available, catering to different learning needs.

- The customer relationship team consistently provides great support, ensuring a smooth user experience.

- Quick and efficient responses from the support team, with a focus on solving issues promptly.

What you may not like:

- No detailed PDF manuals available for making course content revisions.

- The management console can sometimes feel difficult to navigate.

- Some users may find certain aspects of compliance course management unclear or challenging to manage.

Pricing:

Starts at $378.38/year. Mandatory assignments. Ability to set mandatory training assignments for employees.

Get Free LMS Software — All Features, Forever.

We've helped 567 companies train 200,000+ employees. Create courses in under a minute with our AI LMS or use 200+ ready-made courses on compliance, harassment, DEI, onboarding, and more!

Evaluation Criteria

To make sure the tools included in this list are valuable, I followed a detailed evaluation process that balances personal experience and insights from trusted sources. Here’s what I considered:

- User Reviews & Ratings: I reviewed feedback from real users across reputable platforms. This provided a clear understanding of their experiences, common issues, and how well the tools worked in practice.

- Essential Features & Functionality: Next, every feature of the tool was thoroughly explored to measure practicality and usefulness. I focused on whether they offered meaningful solutions and delivered on expectations.

- Ease of Use: This is another criterion that I considered when listing the tools. I examined the design, navigation, and overall user experience to see how intuitive the tools felt for beginners and experts.

- Customer Support: I assessed the quality of customer support too, focusing on how efficiently they resolved issues and helped with setup.

- Value for Money: I compared each tool’s price with its features and performance to ensure readers know exactly how much value they would receive for their investment.

- Personal Experience & Expert Insights: Lastly, I added insights from my own experiences along with opinions from industry experts to provide a balanced and fair perspective.

Which Is the Best LMS in the Banking Domain?

When choosing a banking LMS, you need to consider key factors that include security, compliance support, easy-to-customize content, integration with other tools, scalability, ease of use, mobile access, and customer service.

I have considered these factors, and based on that, here are my top picks:

Option A: ProProfs

ProProfs Training Maker is great for finance training. It offers various ready-to-use courses, making it easy to start with compliance and onboarding training. Its simple design, real-time tracking, and recognition features stand out.

Option B: GyrusAim

GyrusAim is vital in banking training. It supports multiple languages and personalizes learning experiences. Its competency ratings make skill checks and compliance easier. It also offers detailed learner performance data and integration features, though it can have a bit of a learning curve.

Option C: SkyPrep

SkyPrep makes training simple and fun. It keeps your team engaged and helps them learn new skills quickly. With all training materials in one place, employees can find what they need anytime. Plus, you can track their progress.

Out of the three, I’d pick ProProfs as the best choice. It offers full support for finance training with customization options and real-time tracking that help financial institutions.

How to Implement an LMS in a Banking Environment

Implementing an LMS in a bank involves identifying training needs like compliance or onboarding. Next, look for an LMS that offers robust security, customization, and mobile access.

After selecting the system, customize the courses to fit the bank’s specific policies and procedures. Then, train staff on how to use the platform effectively. Make sure employees know how to access courses and track their progress.

Finally, monitor learning progress and gather feedback to improve the system continuously. This ensures staff stay compliant and up to date with required training.

Common Challenges of LMS in Banking and How to Overcome Them

Introducing an LMS in a bank can present several challenges. From gaining employee buy-in to addressing security concerns, each hurdle offers an opportunity to enhance training processes. Below are common problems encountered when implementing an LMS in banking, along with practical solutions:

| Problem | Solution |

|---|---|

| Employee Resistance | Show employees how easy and quick learning can be with the LMS. Live demos and quick wins help get them excited. |

| Security Concerns | Pick an LMS that has strong security features and check regularly to make sure it meets all the rules. |

| Integration Issues | Bring the IT team in early to make sure the LMS works well with the bank’s other systems. |

| Outdated and Boring Content | Keep training materials fresh with videos, fun quizzes, and regular updates to keep everyone interested. |

| Lack of Management Support | Get management involved by showing them how the LMS can benefit the bank and align with its goals. |

| Insufficient Training Resources | Offer clear training on how to use the LMS effectively, including guides and support to help everyone adjust. |

Get Free LMS Software — All Features, Forever.

We've helped 567 companies train 200,000+ employees. Create courses in under a minute with our AI LMS or use 200+ ready-made courses on compliance, harassment, DEI, onboarding, and more!

Ready to Choose the Right LMS for Banking?

Now that you know the best LMS for banking available, it’s time to take action. A well-chosen LMS can transform a banking team’s performance, ensure compliance, boost skills, and keep everyone up to speed with industry changes. With regulations tightening and technology advancing, investing in a strong LMS is a decision you can’t afford to delay.

Focusing on security, customization, and ease of use will help you find the right platform to keep your team engaged and ahead of the curve. Implementing an LMS isn’t just about ticking a box but making sure your employees are equipped to steer through the future of finance.

So here’s my advice: take what you’ve learned, assess your team’s needs, and explore the LMS options that will give you the most value. Your team deserves the best, and your organization will thrive. The time to act is now – empower your workforce and secure the future success of your business!

Frequently Asked Questions

How to choose the right LMS for my banking institution

Choosing the right Learning Management System (LMS) for your banking institution starts with understanding your needs. Consider the types of training required, such as compliance, product knowledge, or customer service. Look for an LMS that offers features tailored to those needs, like robust reporting tools or mobile access for on-the-go training. Check for user-friendly interfaces since employees will engage with the platform regularly. Finally, read reviews and ask for demos to see how well the LMS fits your organization’s culture and workflow. Watch this How to Choose the Best SaaS LMS Software

How can an LMS improve regulatory compliance in banks?

An LMS plays a vital role in enhancing regulatory compliance within banks. It streamlines the training process, ensuring that employees receive up-to-date information on regulations. The system can track completion rates, provide reminders for re-training, and generate reports to demonstrate compliance to regulators. With an LMS, banks can easily update training materials in response to changing laws, ensuring that employees always have access to the most current information.

How long does it take to implement an LMS in a bank?

The timeline for implementing an LMS in a bank varies based on several factors, including the size of the organization and the complexity of the chosen system. Generally, expect a few weeks to several months for full implementation. Initial steps involve needs assessment, system configuration, and integration with existing tools. After that, train your employees on how to use the system. Proper planning and engagement can significantly shorten the timeline.

Can an LMS be customized for different roles within a bank?

Yes, an LMS can be customized for different roles within a bank. Many platforms offer role-based learning paths that cater to specific job functions, ensuring relevant training for each employee. For instance, a teller might require training on cash handling procedures, while a loan officer may need in-depth knowledge of credit regulations. Customization helps ensure that every employee receives the training they need to perform their jobs effectively.

Tips

Tips

We’d love to hear your tips & suggestions on this article!

Get Free LMS Software — All Features, Forever.

We've helped 567 companies train 200,000+ employees. Create courses in under a minute with our AI LMS or use 200+ ready-made courses on compliance, harassment, DEI, onboarding, and more!

We'd love your feedback!

We'd love your feedback! Thanks for your feedback!

Thanks for your feedback!